8 Annuity-Immediate

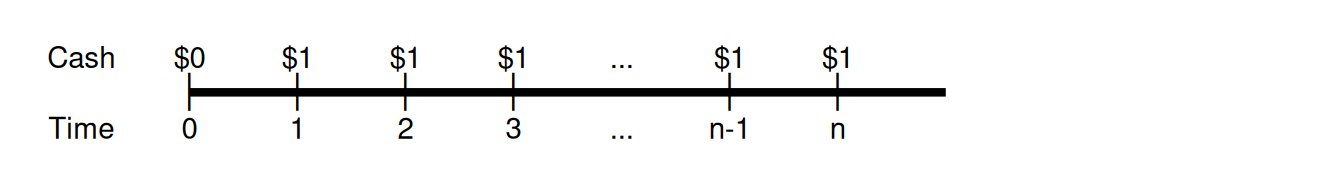

Consider an annuity with payments of \(1\) unit each, made at the end of every period for \(n\) years. periods. This kind of annuity is called an annuity-immediate (also called an ordinary annuity or an annuity in arrears).

8.1 PV and AV of an Annuity Immediate

8.1.1 Present Value of an Annuity-Immediate

The symbol \(a_{\overline{n}|i}\) denotes the present value of an annuity-immediate of \(n\) payments with the rate of interest per payment period is \(i\), when the valuation point is one payment period before the payments begin. The formula for \(a_{\overline n|i}\) is:

\[\begin{align} a_{\overline n|i} &= v+v^2 + ... + v^n \\ &=\sum_{t=1}^n v^t = \frac{1-v^n}{i} \end{align}\]

8.1.2 Accumulated Value of an Annuity-Immediate

The symbol \(s_{\overline{n}|i}\) denotes the accumulated value of an annuity-immediate of \(n\) payments with the rate of interest per payment period is \(i\), when the valuation point is right after the last payment. The formula for \(s_{\overline n|i}\) is

\[\begin{align}s_{\overline n|i} &= (1+i)^{n-1} + ... + (1+i) + 1\\ &= \sum_{t=0}^{n-1} (1+i)^t =\frac{(1+i)^n-1}{i}\end{align}\] The cash flow of an annuity-immediate can be demonstrated through this time diagram:

Example: Calculate the present value of an annuity-immediate of amount $100 payable quarterly for 10 years at the annual rate of interest of 8% convertible quarterly. Also calculate its future value at the end of 10 years.

Solution: Note that the number of periods is \(4 \times 10 = 40\). The one-period rate of interest \(j = 8\%/4 = 2\%\).

The present value of this annuity-immediate is \[100a_{\overline{40}|0.02} = 100\times \frac{1-(1.02)^{-40}}{0.02} = 2735.55\] And the future value of this annuity-immediate is \[100 s_{\overline{40}|0.02} = 100 \times a_{\overline{40}|0.02} \times (1.02)^{40 }= 6040.20\] ### Calculator Guide

We can use the TVM worksheet on the BA II Plus (Professional) Financial Calculator to work out annuity problems.

Example: The annual effective interest rate is \(4\%\). An annuity-immediate makes payments of \(\$5\) at the end of each year for 8 years. Find the present value of the annuity-immediate.

Solution: Using the BA II, we can calculate the present value with the following keystrokes (assuming TVM worksheet has been cleared and mode is set to END):

8 [N] 4 [I/Y] 5[PMT] [CPT] [PV] -> PV = -33.66

Thus the PV of this annuity-immediate is 33.66

8.1.3 Remark

The BA II can solve for any one of the folowing if the other 4 are provided: N, I/Y, PV, PMT, FV, where:

N: Number of PeriodsI/Y: Interest Rate per Year (in %)PV: Present ValuePMT: PaymentFV: Future Value

by solving the Equation of Value: \[PV + PMT \times a_{\overline{N|} I/Y} + FV \times v^N = 0\]

8.2 Perpetuity-Immediate

A perpetuity-immediate is an annuity-immediate that pays out forever. The present value of a perpetuity-immediate that pays 1 at the end of each time unit forever is:

\[a_{\overline{\infty|}i} = \lim_{n\to\infty} a_{\overline{n|}i} = \lim_{n\to\infty}\frac{1-v^n}{i} = \frac{1}{i}\]

Example: The annual effective interest rate is \(6\%\). A perpetuity-immediate makes payments of \(\$5\) at the end of each year forever. Calculate the present value of the perpetuity-immediate.

Solution: The present value is \(PV_0 = 5 a_{\overline{\infty|}6\%} = \frac{5}{0.06}= 83.33\)